Special Trusts Offer Flexible Giving Options

There are two primary types of charitable remainder trusts: the charitable remainder annuity trust, which provides you with a level of predictable fixed income, and the charitable remainder unitrust, which provides you with a variable income.

How a charitable remainder trust works:

- A trust is drafted by an appropriate professional advisor.

- Assets are transferred to the trust to be managed by you or another person or an entity you choose as trustee.

- Payments are made from the trust to you and/or others you name for life or certain period of years.

- You are entitled to a federal (and perhaps state) income tax charitable deduction, and you may enjoy capital gains tax savings in the year you create the trust. Amounts used to fund your trust may not be part of your probate or taxable estate.

- When the trust ends, its remaining assets become a gift to the charity of your choosing. The gift portion is known as the charitable remainder.

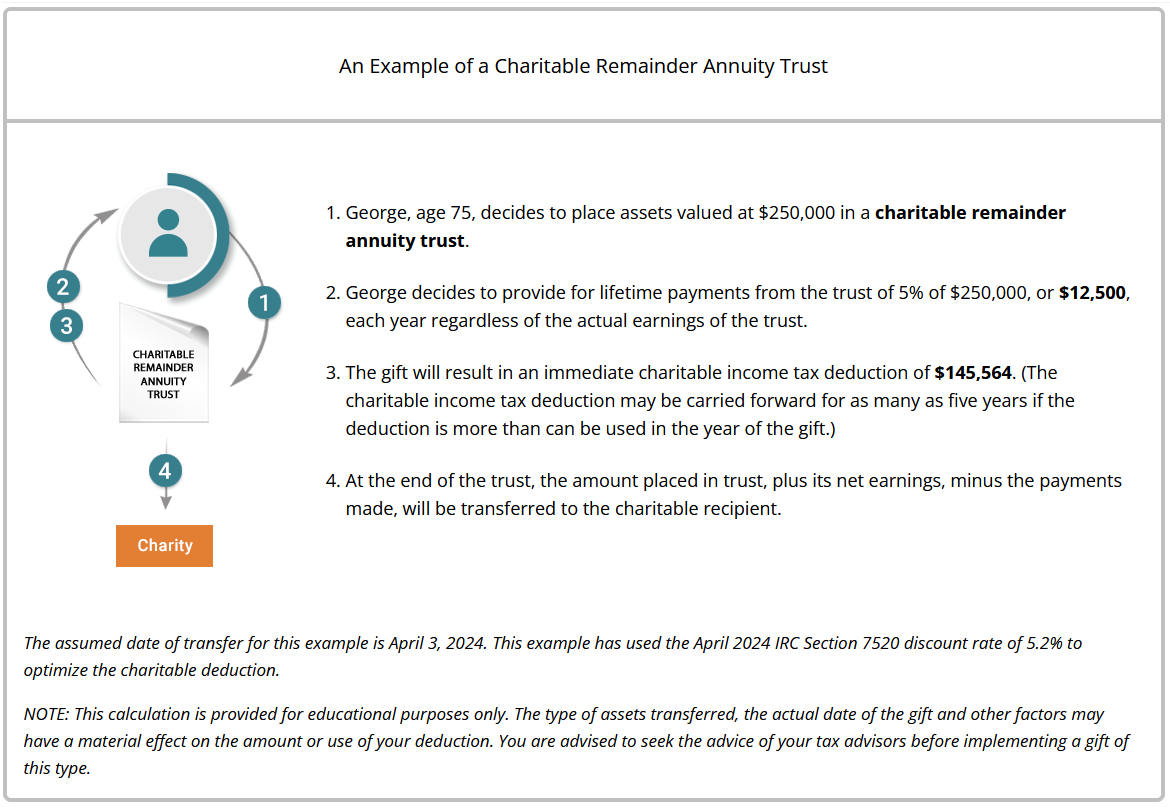

If You Want a Predictable Income …

A charitable remainder annuity trust is a way to make a gift while ensuring a fixed, regular income. Income from such a trust can be a reliable income supplement in retirement years. The payments received each year must be at least 5% of the amount originally placed in the trust. You determine the exact amount when your trust is created.

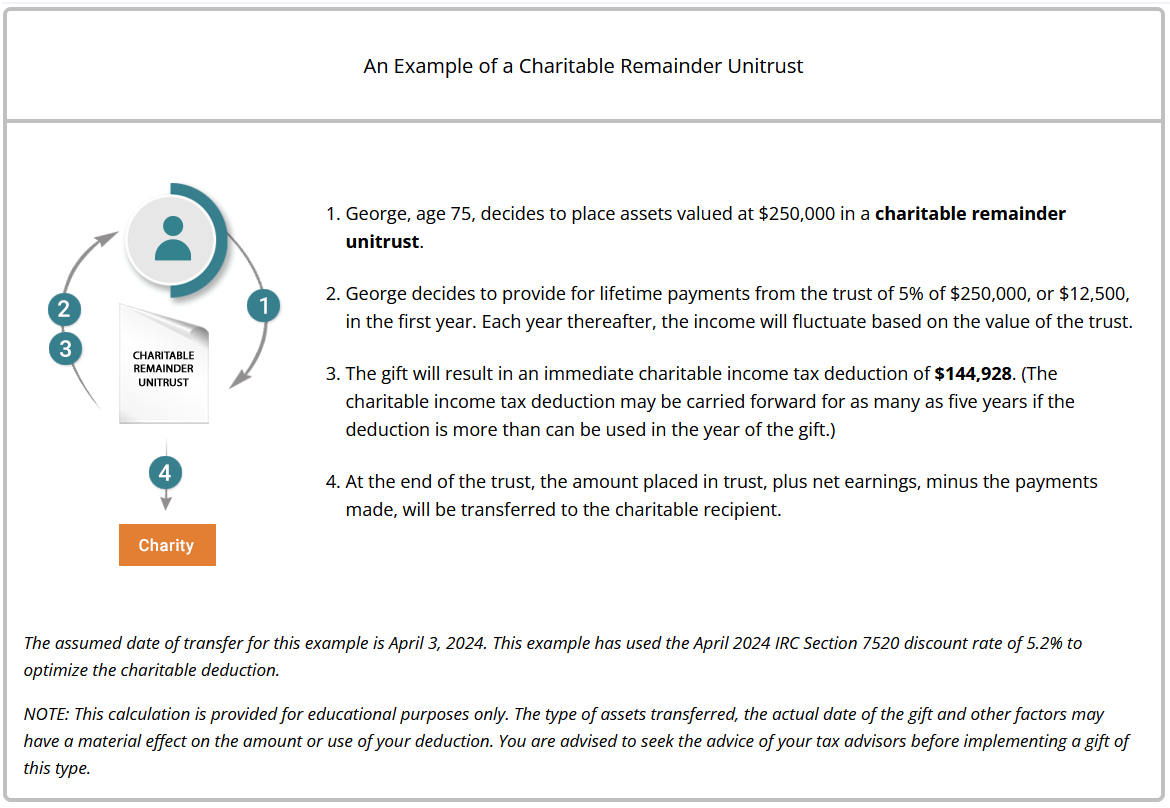

If You Prefer a Variable Income …

Like the annuity trust, the charitable remainder unitrust provides for a gift that allows a donor to retain income for life or other period of time. Unlike the annuity trust, the income from a unitrust can fluctuate over time with the value of the assets placed in the trust.

You determine the annual payment percentage when the gift is made. Each year, this percentage (at least 5%) of the value of the trust assets is paid to you or others you name. When the value of the investments goes higher, more income is received. The income will be less if the value of the assets declines. If provided for in the trust agreement, additions can be made to a unitrust, and an additional tax deduction is allowed for part of any additional amounts contributed.

For those who would like an income that can grow over time, the charitable remainder unitrust can be an attractive option. Another benefit is the fact that no tax is payable by the trust at the time investment gains are realized, making it possible to enjoy increased income over time based on tax-free growth within the trust. This can be a good choice for those who anticipate increases in growth in investments over time.

If You Want Income for a Period of Time …

It is also possible to establish a charitable remainder trust for a fixed time period of up to 20 years. Such a trust may be useful if you would like to retain income to meet your needs over a limited time frame. The trust can also provide income for one or more loved ones for a particular term of years.

New Opportunity To Fund a Charitable Remainder Trust With an IRA Distribution

Beginning in 2023, the Consolidated Appropriations Act, 2023 permits a one-time election to be made for QCD gifts up to $50,000 (adjusted annually for inflation) to charitable remainder trusts. For 2024, the amount is $53,000. The remainder trusts must be funded exclusively by the QCDs and may make non-assignable payments only to the IRA owner and/or spouse. All payments from charitable remainder trusts will be taxed as ordinary income.