Charitable Gift Annuities Provide Lifetime Payments

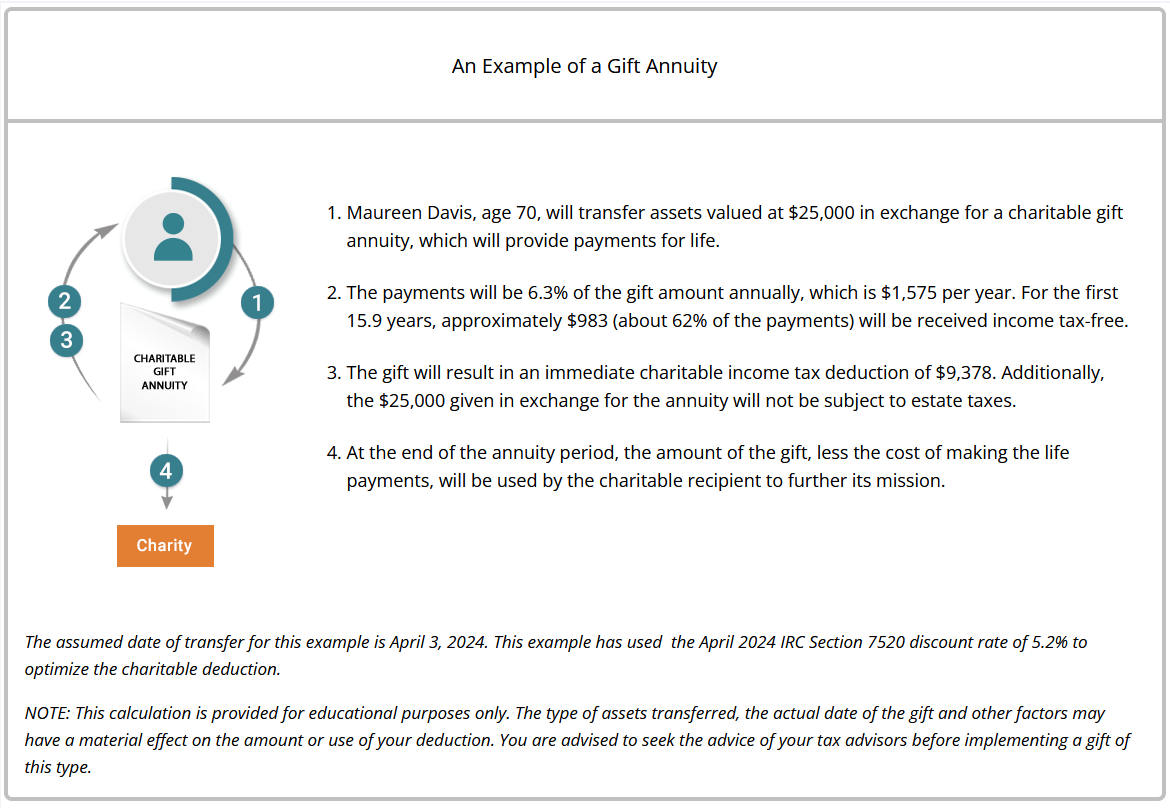

A charitable gift annuity is an arrangement where, in exchange for your gift of cash, stock or other property, we agree to make fixed payments for life to one or two individuals.

Among the other benefits of a charitable gift annuity:

- Highest payments in 16 years.

- An income tax charitable deduction for a portion of the amount contributed.

- Part of the annuity payment you receive each year will be tax-free for your life expectancy.

- If your gift annuity is funded with appreciated stock held more than one year, you can avoid a portion of the capital gains tax that you would owe if you sold the stock; your annuity payments are based on the full value of the shares.

- You provide important support for our future.

Most people establish gift annuities for themselves (or themselves and a spouse), but the charitable gift annuity is an extremely versatile gift plan. Gift annuities can be established to benefit another person (an elderly parent, for example) and can be funded through an estate plan, providing lifetime payments to a family member, employee or friend.

When You Don’t Need Income Today

It’s possible to postpone the start of gift annuity payments until some later date—retirement, for example, with a deferred payment gift annuity. Not only is the charitable deduction larger when the start of the gift annuity is deferred. But payments are also increased.

A deferred payment gift annuity is an excellent way to shift income from your high-earning years to retirement, augmenting your IRA, 401(k) and other retirement savings. Unlike an IRA contribution, your deferred payment gift annuity can be funded with appreciated stock for added tax savings. A flexible deferred gift annuity allows you to decide when to begin the payments in the future.

Funding a Gift Annuity With an IRA Distribution

Recent legislation permits a one-time election to be made for a charitable gift annuity funded with a QCD in an amount up to $53,000 this year (adjusted annually for inflation). The gift annuity must be funded exclusively by the QCD and may make non-assignable payments only to the IRA owner and/or spouse. QCDs used to fund gift annuities will not be treated as an investment in the contract, meaning no portion of the annual payment will be tax-free.