Cash—A Popular Gift

We commonly receive gifts in the form of cash, checks and electronic transfers. Cash gifts can be convenient for many people and are easily recorded through receipts and bank records. Remember that it is important to save all receipts for tax purposes.

Noncash Gifts Offer Multiple Benefits

When Assets Are Worth More

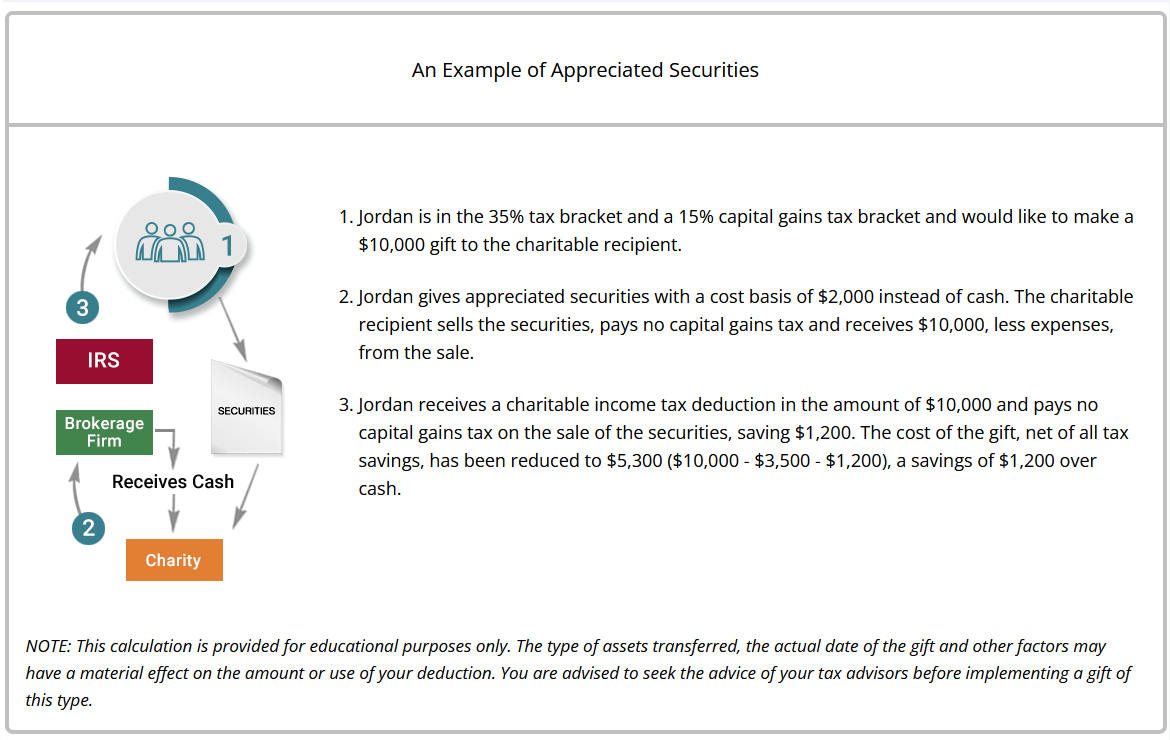

If you have property, such as stocks and mutual funds, that is worth more than you paid for it and it has been owned for more than a year, you may enjoy greater tax savings from giving that property than from giving the same amount of cash. You may also receive a charitable income tax deduction based on the property’s current value, not just its original cost.

Planning Tip: If you have owned a security for more than a year, it has increased in value and you think it may be worth more in the future, it may be best to donate the stock and at the same time repurchase the same number of shares with the cash you otherwise would have used to make the gift. This will increase the basis in your stock to 100% of its current value and save you capital gains taxes in the future should you sell the stock. This may also make it possible to benefit from a loss deduction should the stock decline in value before it is sold.

Giving Securities That Have Declined in Value

If you have stock or other investment property that is worth less than the original cost, you will normally save more in taxes by selling that property and giving the proceeds. You may then be able to claim a capital loss on your tax return and also deduct the cash proceeds you give as a charitable gift. The result can be that you may enjoy tax deductions that actually total more than the current value of the asset while making a meaningful gift.

Other Assets

Check with us or your advisors about other noncash assets that might be given as charitable gifts.